Continuous Planning is the FP&A process of gathering information, forecasting resources, and analysing outcomes - to help organisations make prudent decisions that drive profitable growth. This approach recognizes that ongoing adjustments must be made due to changing market conditions, allowing businesses to remain agile and responsive to their ever-evolving environment. Continuous Planning requires a vision and culture to ensure long-term strategic goals are met and financial resources are managed effectively through rolling forecasts.

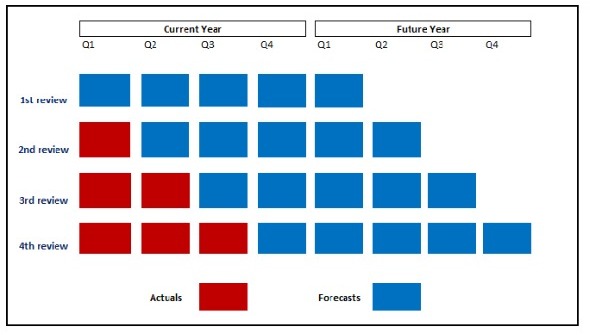

Continuous Planning uses rolling forecasts instead of long term views with firm numbers and incorporates techniques like scenario-planning to prepare for future market uncertainties. Continuous Planning allows organisations to rapidly iterate plans, strategies, and balances in response to new market signals while keeping longer-term objectives fixed – leading to smarter decisions over time and improved financial performance. When used in conjunction with sound decision-making and corporate strategy, Continuous Planning can offer businesses the versatility needed for continued success in today's competitive landscape.

What businesses have realised in the recent uncertain times:

Companies can optimize their performance as the business environment changes by using a continuous planning approach. For executives, COVID-19 has been a major eye-opener. It has become clear that the uncontrolled factors can entirely overshadow what corporate leaders believed they had control over. FP&A teams are aware of this and are aware that making judgments with confidence is challenging. FP&A professionals need to be prepared to evaluate a variety of situations in their capacity as strategic advisors to the C-suite and course-correct more frequently, presuming most decisions will be somewhat off the mark. Because of this, their planning needs to be more incremental, making it naturally fluid and allowing for course correction before they go too far down a road.

However, without enabling technology, it can be challenging to access all of the pertinent data that is kept by business units throughout the organization, most of which is kept in segregated spreadsheets. Without a single source of truth on a shared platform that everyone can access and utilize together, Finance executives find it challenging to work with budget owners.

Business dynamics are without a doubt evolving at an accelerated rate. Additionally, a business' planning procedure must accommodate this dynamic environment. In order to meet the demands of a constantly shifting context, there is a tendency away from static, annual planning models and toward more continuous, dynamic ones. How to modify a company's planning procedures so that decision-making is continuous at predetermined intervals hence preventing them from being quickly rendered obsolete.